Bentley Systems, Incorporated’s (NASDAQ:BSY) business continues to perform strongly, with government stimulus directed at infrastructure projects likely to continue providing tailwinds in coming years. Bentley’s broad, and expanding, product portfolio positions it to capitalize on this, although competition from companies like Autodesk, Inc. (ADSK) is increasing. Solid growth and improving margins in coming years are more than reflected in Bentley’s share price though, making it unlikely that the company significantly outperforms the market over a longer time frame.

Market

Bentley Systems provides software to infrastructure organizations and hence is exposed to a range of diverse end markets and demand drivers. Public works and the utility infrastructure sector in the US are areas of particular strength at the moment on the back of enormous stimulus programs. Nearly half of Bentley Systems’ ARR comes from these areas, helping the company to thrive, even as most other software companies struggle.

The Bipartisan Infrastructure Law is in addition to other large stimulus programs, like the Inflation Reduction Act and the CHIPS and Science Act, although Bentley is less likely to be a direct beneficiary of these. The Bipartisan Infrastructure Law has made over 850 billion USD in total funding available, which is being directed toward areas like water, road, rail, airports, and power infrastructure. The law has an authorizing period of five years, but spending is likely to last beyond this.

While transportation funding is no longer increasing, it will continue to flow for the next few years. BIL funding is starting to shift into areas like water, broadband, and the electricity grid. Electricity grid projects are still waiting on transmission capacity permits though. Demands placed on the electricity grid by increased electrification (EVs) and renewables (variable and distributed production) require grid improvements, with the IEA believing that transmission and distribution spend needs to double to support climate change targets.

Bentley Systems believes that there is currently a capacity gap in the industry which is forcing infrastructure engineering organizations to invest in digital capabilities, driving demand for its software. This is supported by the ACEC survey of US engineering firms across all sectors, which shows a medium current backlog of 11 months.

While infrastructure spending is currently a large tailwind, investors need to consider what will happen when the current wave of projects is completed. An infrastructure spending hangover seems likely, although this won’t happen for a number of years. As a software provider, this may not necessarily be overly negative for Bentley though, particularly if the company can successfully drive adoption of its software in the operation and maintenance stage of the project lifecycle in coming years.

Strength in public works/utilities is likely being somewhat offset by weakness in commercial real estate, which could increase going forward. The resources sector is also likely to come under pressure going forward after a strong multi-year period. Bentley’s resource sector revenue is more tied to the operation of existing assets than investments in exploration though, which should limit headwinds in the event of a downturn.

Bentley’s diversified product portfolio means that it faces a range of competitors, with competition varying depending on the end market. Most of Bentley’s competitors are large, mature, and well-resourced companies. While this means competition is likely to be stiff, competitive dynamics are also likely to be fairly stable. The rising importance of data and cloud computing should drive consolidation over time, which should benefit market leaders like Bentley.

Competition includes:

- Public works/utilities – Autodesk, Trimble, Hexagon.

- Industrial – Hexagon, AVEVA unit of Schneider Electric, Dassault Systemes.

- Resources – Hexagon, AVEVA unit of Schneider Electric, Dassault Systemes.

- Commercial/facilities – Autodesk, Nemeteschek, Trimble.

- Project delivery systems – Autodesk, Oracle.

- Asset performance systems – Aspen Technology, AVEVA unit of Schneider Electric, Environmental Systems Research Institute, General Electric.

Autodesk has been investing in road and rail over the past 5-10 years and this is now beginning to pay off, as are more recent investments in water. Autodesk acquired Innovyze in 2021, providing access to water infrastructure modeling and simulation software that supports the design of water distribution networks, water collection systems, water and wastewater treatment plants, and flood protection systems.

Bentley Systems

Bentley Systems provides a range of software and cloud services to infrastructure organizations that help them to design, build, and operate infrastructure. Target infrastructure sectors include:

- Public works (like roads, rail, bridges, airports) and utilities (including electricity, gas, communications, and water).

- Resources (mining, upstream oil and gas, pipelines, environmental management, and renewable energy).

- Industrial (manufacturing, downstream oil and gas, and power generation).

- Commercial/facilities (including office buildings, retail facilities, hospitals, and campuses).

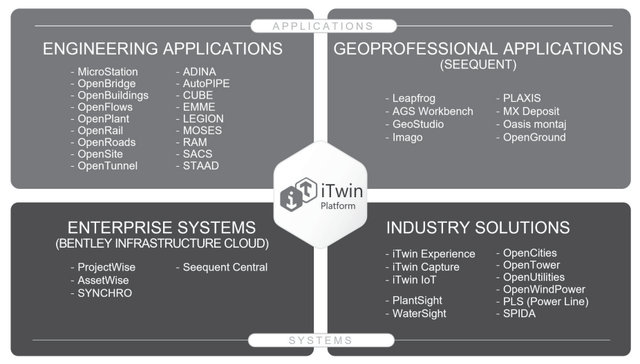

Bentley offers applications and enterprise information systems that address both the project and asset lifecycle phases of infrastructure. Project Lifecycle solutions encompass conception, planning, surveying, design, engineering, simulation, and construction. Asset Lifecycle solutions span the operating life of commissioned infrastructure assets, supporting operating and maintenance decisions. Bentley’s applications are broadly grouped under Engineering Applications (modeling and simulation) and Geoprofessional Applications (modeling and simulation of subsurface conditions). Bentley’s Enterprise Systems support data management and collaborative workflows for both project delivery and asset performance. Bentley’s Industry Solutions targets domain-specific problems for owners of infrastructure assets.

Figure 1: Bentley Systems Solutions (source: Bentley Systems)

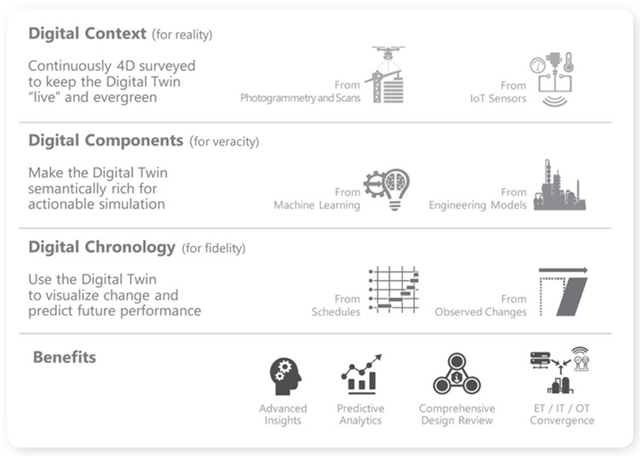

Bentley also offers iTwin Platform, an infrastructure digital twin solution that enables customers to create digital representations of their physical infrastructure assets, supporting the operation and maintenance of assets. The iTwin Platform also supports Bentley’s project delivery, 4D construction, and asset performance offerings.

Figure 2: Aspects and Benefits of Digital Twins (source: Bentley Systems)

Seequent, along with Power Line Systems, is currently one of the fastest-growing parts of Bentley’s business. This is despite the fact that the macro environment has contributed to a slowdown in exploration activity. Seequent is more dependent on the operation and expansion of existing mines than exploration activity though.

Acquisitions

Bentley Systems has been an active acquirer in recent years in support of increasing its scale and the scope of its platform. Acquisitions include:

- GroupBC (2020) – provides additional common data environment solutions for construction projects and infrastructure assets, supporting Bentley’s digital twin business.

- Cohesive Solutions (2020) – provides digital integrator expertise for the convergence of digital engineering models, with IT and OT, for infrastructure assets.

- Seequent (2021) – supports the incorporation of subsurface simulation into infrastructure digital twins.

- Inro (2021) – traffic simulation software for multi-modal mobility digital twins.

- Vista Data Vision (2021) – allows infrastructure digital twins to incorporate real-time sensor data.

- SPIDA Software (2021) – adds design, analysis, and management of utility pole systems to Bentley’s grid digital twin solutions.

- Power Line Systems (2022) – design, analysis, and management of overhead electric power transmission lines and structures for Bentley’s grid digital twin solutions.

- Adina R&D (2022) – non-linear simulation capabilities for infrastructure engineering.

- Vetasi (2022) – IBM Maximo and enterprise asset management system consultancy team.

- Blyncsy (2023) – a solution that leverages crowd-sourced data and AI to help roadway operators identify problems requiring maintenance.

- Flow State Solutions (2023) – geothermal simulation software which helps operators better understand and optimize geothermal resources.

- EasyPower (2023) – software tools that help electrical engineers design and analyze power distribution systems for industrial and commercial facilities.

Acquisitions generally appear to be targeted at building out specific capabilities, with most of these recent acquisitions enhancing Bentley’s digital twin, power grid, and subsurface solutions. Bentley can likely add significant value to acquisitions through cost synergies, and by leveraging its distribution footprint to drive revenue growth.

Customers

Bentley provides solutions to over 40,000 accounts in 194 countries worldwide. No account, including any group of affiliated accounts, represented more than 2% of Bentley’s revenues in 2022. Revenue comes from engineering and construction contracting firms (~ 50% of revenue) and their clients (~ 50% of revenue). While asset owners contribute roughly half of Bentley’s revenue, this is still mostly from software related to the design phase of the infrastructure cycle. Penetration of the operations phase is therefore a large growth opportunity.

AI

Rapidly increasing AI capabilities are both an opportunity and a threat. Bentley is currently developing AI to automate time-consuming tasks during the design process and aid decision making. For example, Bentley has an AI agent that helps engineers optimize site layouts by leveraging designs and data from previous projects.

As a large incumbent, Bentley is well-positioned to capitalize on the AI opportunity, but every competitor is pursuing the same opportunity. For example, Autodesk is also working on AI to automate repetitive tasks and generate improved designs. Autodesk’s AI solutions are built on a wealth of data which few companies can compete with. Bentley has stated that it will use its own engineering applications to train AI agents, rather than user data.

Financial Analysis

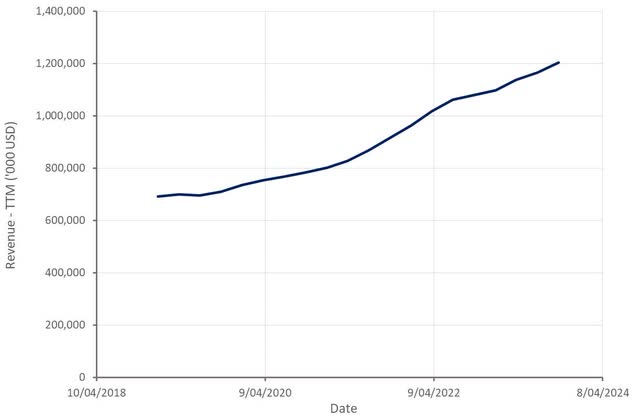

ARR growth was 12.5% YoY in the third quarter of 2023, although this was negatively impacted by a smaller number of workdays in the quarter. Third quarter revenue was 307 million USD, up 14% YoY or 11% in constant currency. Subscription revenue grew 15% YoY and represented 88% of total revenue. E365 and SMB initiatives continue to be solid contributors to subscription revenue growth.

Virtuoso subscriptions contributed over 700 new logos in the third quarter. Bentley also added nearly 300 incremental new SMB logos through perpetual license sales. Perpetual licenses were an area of strength for Bentley in the third quarter, some of which was due to the company’s focus on localization in China. As a result, Bentley’s ARR in China is declining, although revenue was up YoY.

Bentley’s Americas revenue was solid in the third quarter, driven by federally supported programs. Bentley’s growth rate with DOTs increased 50% YoY. EMEA growth is also being driven by public funding for projects across transportation, water, and energy.

Bentley’s net retention rate remains at high levels (~110%), as does the company’s account retention rate (~97%). New logos contributed 3% to ARR growth in the third quarter.

Figure 3: Bentley Systems Revenue (source: Created by author using data from Bentley Systems)

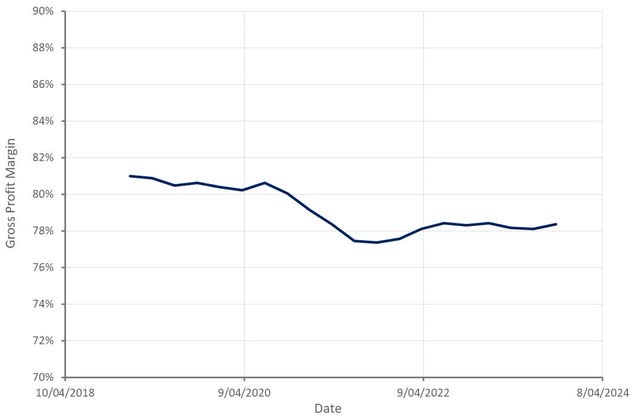

While Bentley’s gross profit margin has declined somewhat over the past few years, it still sits at a relatively high level. Growing adoption of cloud solutions may prevent Bentley’s gross profit margin from moving much higher, but the company is capable of generating significant free cash flow with current gross profit margins.

Figure 4: Bentley Systems Gross Profit Margin (source: Created by author using data from Bentley Systems)

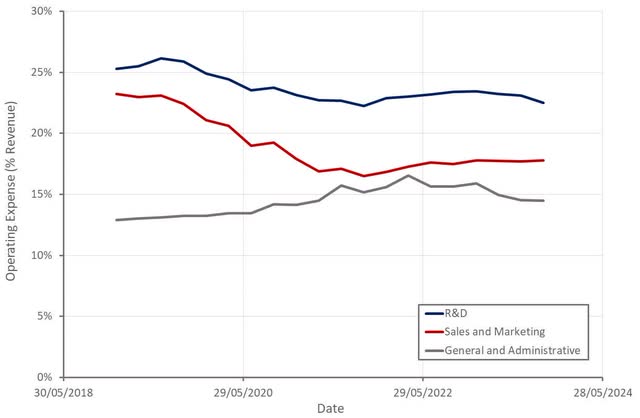

While Bentley is already highly profitable, the company’s operating expenses suggest that there is still significant room for improvement. Bentley’s operating profit margins have been hovering around 20% but given current R&D and general and administrative expenses, I expect Bentley to eventually push its operating profit margin to well over 30%.

Figure 5: Bentley Systems Operating Expenses (source: Created by author using data from Bentley Systems)

Conclusion

Bentley has a solid competitive position and can likely drive margins significantly higher, both of which support a high valuation. Bentley trades at a large premium to similar companies though, and its EV/S multiple is more in line with companies generating in excess of 30% revenue growth or operating profit margins approaching 50%.

Bentley is currently benefitting from a healthy demand environment and should continue to report strong growth in the coming years. In particular, its exposure to rising electricity grid investments should be a growth driver in 2024. Despite this, it is difficult to see Bentley’s stock outperforming the market significantly over a longer time frame due to its elevated valuation.

Figure 6: Bentley Systems EV/S Multiple (source: Seeking Alpha)

Read the full article here