Investment Thesis

This article discusses the Strive 500 ETF (NYSEARCA:STRV), an ETF that holds 500 of the largest U.S. stocks and weights them by free-float market capitalization. It’s a lot like the SPDR S&P 500 ETF Trust (SPY), but the main differentiator is that Strive Asset Management promotes “shareholder primacy,” where decisions are made in the best interests of shareholders rather than all stakeholders. For Strive to accomplish its objectives, investors must part way with similarly structured funds like SPY, but the Index STRV tracks aren’t different enough to make the switch practical. My analysis reveals a 96.33% overlap by weight with SPY, with weighting differences of 0.20% for all but two stocks. Therefore, despite similarly strong fundamentals as SPY, I recommend investors avoid STRV, and I look forward to explaining why in further detail below.

Strive’s Purpose

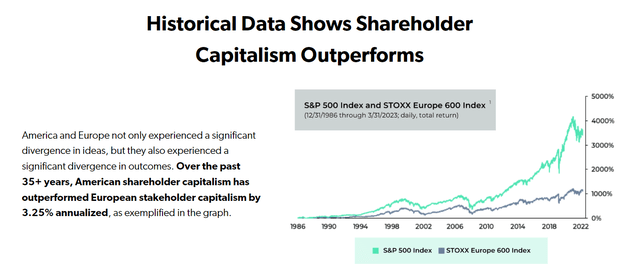

Strive Asset Management was co-founded in 2022 by Vivek Ramaswamy, a 38-year-old entrepreneur and 2024 Republican Presidential Candidate. STRV is the second-most-successful product in the firm’s equity ETF lineup behind the Strive U.S. Energy ETF (DRLL), though the two are neck-and-neck, with $325 and $336 billion in assets under management, respectively. According to Strive’s website, the firm’s employees “live by a strict commitment to shareholder primacy – an unwavering mandate that the purpose of a for-profit corporation is to maximum long-run value to investors.” Strive uses the success of the S&P 500 since 1986 to illustrate how shareholder capitalism led to better outcomes than the STOXX Europe 600 Index, which represents companies in countries that largely favor stakeholder capitalism.

Strive Asset Management

The above chart reads close to a warning that if the United States goes the route of stakeholder capitalism, annualized long-term returns could shrink by 3.25%, and pension funds would become insolvent. Stakeholder capitalism is a practice already signed onto by nearly 200 U.S. CEOs covering every sector of the U.S. economy. The revised statement on the Purpose of a Corporation of the Business Roundtable covers the following:

1. Delivering value to customers.

2. Investing in employees by compensating them fairly and providing important benefits like training and education.

3. Dealing fairly and ethically with suppliers.

4. Providing community support.

5. Generating long-term value for shareholders, which includes transparency and effective engagement.

Crucially, the statement concludes with the following:

Each of our stakeholders is essential. We commit to deliver value to all of them, for the future success of our companies, our communities and our country.

It’s this final part that Strive takes issue with, and I’m assuming points #2, #3, and #4 in particular, as they are the most ESG-related. However, the business leaders who signed the statement, including Jamie Dimon of JPMorgan Chase (JPM) and Tricia Griffith of The Progressive Corporation (PGR), see it differently. Griffith writes:

CEOs work to generate profits and return value to shareholders, but the best-run companies do more. They put the customer first and invest in their employees and communities. In the end, it’s the most promising way to build long-term value.

These CEOs view activities like providing community support as a way to build long-term shareholder wealth rather than an unnecessary cost of doing business. In short, the goals of shareholders and other stakeholders are not necessarily mutually exclusive. Nevertheless, the point could be moot. Though Strive is poised to reach the $1 billion mark in combined AUM across its 11 ETFs, it’s tiny compared to asset managers like BlackRock, State Street Global Advisors, and Vanguard. As Columbia Business School finance professor Shivaram Rajgopal put to Ramaswamy, “Why would the CEO of Apple listen to you if you own 0.02% of stock?”

It’s a good question and sums up my view that even if an investor believes in Strive’s mission, investing in STRV won’t matter. However, Strive’s other products, particularly DRLL and STXE, an Emerging Markets ex-China ETF, seem to better reflect the firm’s vision.

STRV Analysis

Top Ten Holdings

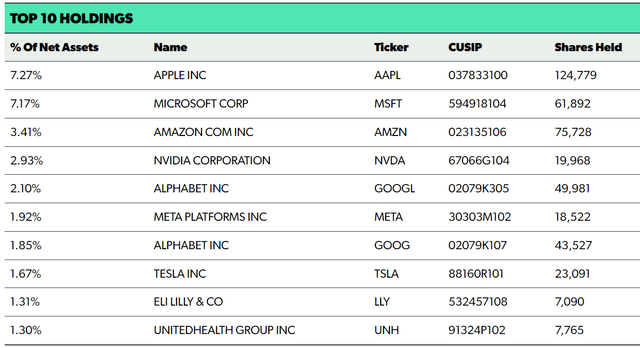

STRV’s similarities with SPY mean it is a solid “core” investment. Its top ten list is almost identical and includes Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN) at 7.27%, 7.17%, and 3.41% weightings. These stocks’ weightings in SPY are 7.34%, 7.33%, and 3.48%, so there isn’t too much difference at the top. The main difference is that Berkshire Hathaway (BRK.B), SPY’s #8 holding, is #11 in STRV, with Eli Lilly (LLY) moving up the list.

Strive Asset Management

Fundamentals By Industry

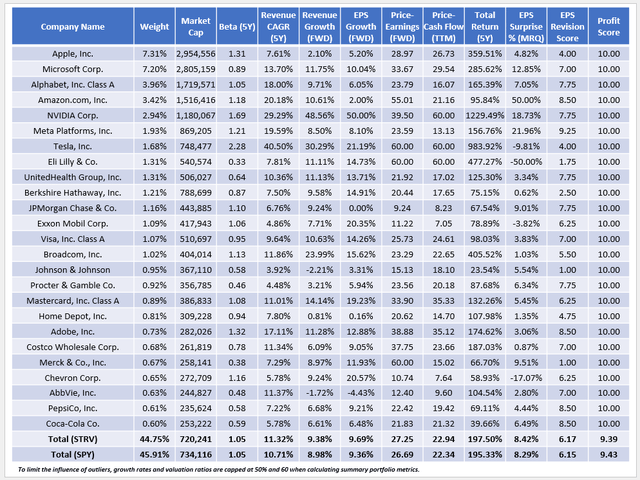

The following table highlights selected fundamental metrics for STRV’s top 25 holdings, totaling 44.75% of the portfolio. As shown, there is hardly any difference with SPY.

The Sunday Investor

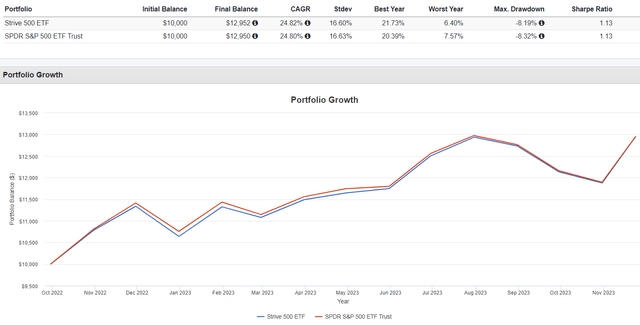

Specifically, STRV and SPY have equal 1.05 five-year betas and nearly identical weighted-average five-year total returns and profit scores. STRV has a slightly greater growth profile, evidenced by a higher forward P/E (27.25x vs. 26.69x) and 0.30%-0.40% more estimated sales and earnings growth, but the difference is negligible. Since its launch, the two have followed a similar path, per the below total returns chart:

Portfolio Visualizer

The most significant differences with SPY include an underweighting of Berkshire Hathaway by 0.51% and an overweighting of Uber Technologies (UBER) by 0.28%. Otherwise, all weight differences are less than 0.20%, so there’s no reason to expect any deviation in performance moving forward.

Investment Recommendation

There are no practical reasons to buy STRV, as Strive Asset Management is still too small to influence the 500 largest U.S. companies. However, its performance and fundamentals are nearly identical to SPY, and it should act as a solid core holding for those looking to support Strive’s mission of advocating for shareholder primacy. Personally, I doubt the dramatic claims of stakeholder capitalism potentially reducing long-term equity returns by an annualized 3.25%. Therefore, while interesting to research, I don’t recommend readers buy STRV. Thank you for reading, and I look forward to the discussion in the comments section below.

Read the full article here